Why RAM Manufacturers Are Abandoning Consumer Memory for AI Data Centers

For decades, the consumer memory market was the quiet backbone of the digital economy. Every laptop upgrade, gaming PC build, smartphone refresh, and enterprise workstation relied on a steady supply of DRAM modules produced at enormous scale by a handful of global manufacturers. RAM was rarely glamorous, but it was dependable, standardized, and broadly accessible. That stability is now breaking.

Over the past few years, the world’s largest memory manufacturers, including Samsung Electronics, SK Hynix, and Micron Technology, have made strategic decisions to reduce their focus on traditional consumer RAM and redirect capital, production capacity, and research toward AI-focused data center memory. This shift is not cosmetic. It is structural, and its consequences are already reshaping both consumer and commercial technology markets worldwide.

This article explores why RAM makers are deprioritizing consumer markets, how AI data centers have changed the economics of memory manufacturing, and what this transition means for everyday users, businesses, and the future of computing itself.

The Historical Role of Consumer RAM in the Tech Ecosystem

For much of the last three decades, consumer RAM operated under a predictable economic model. PC and smartphone manufacturers demanded massive volumes of standardized memory. Consumers expected incremental improvements in speed, density, and power efficiency, delivered at gradually falling prices. Memory makers competed on yield, manufacturing scale, and cost control rather than radical differentiation.

This model had its flaws. Memory pricing was cyclical, margins were thin, and periods of oversupply routinely crushed profitability. Still, consumer RAM kept the business afloat. It provided volume stability, justified multi-billion-dollar fabs, and ensured long-term relevance across multiple device categories. What changed was not consumer demand disappearing, but the emergence of a new buyer willing to pay far more for every bit of memory.

The AI Data Center Revolution and Its Appetite for Memor

Artificial intelligence workloads have fundamentally altered what “memory” means in computing. Training large language models, running inference at scale, and operating in real-time AI services require not just more RAM, but entirely different classes of memory with extreme bandwidth, lower latency, and tighter integration with GPUs and accelerators. High Bandwidth Memory, often stacked directly onto AI processors, has become one of the most valuable components in modern data centers. Unlike consumer DDR modules, these memory systems are custom-designed, difficult to manufacture, and sold in long-term contracts with hyperscalers and AI infrastructure providers.

From a business perspective, the attraction is obvious. AI data center memory delivers higher margins, predictable demand, and strategic importance. It is not a commodity. It is a bottleneck, and bottlenecks command power.

Read more: 7 AI Tools You Must Try in 2025

Why RAM Makers Are Exiting or Scaling Back Consumer Segments

The decision to pivot away from consumer RAM is not driven by a single factor, but by a convergence of economic, technical, and geopolitical realities. Consumer RAM prices have become brutally competitive, with little room for sustained profitability. Even during periods of high demand, gains are often short-lived before new capacity floods the market. In contrast, AI memory sells at a premium and often under multi-year supply agreements.

Manufacturing complexity also plays a role. Advanced memory for AI requires cutting-edge nodes, advanced packaging, and specialized engineering talent. The same fabs used for consumer DDR can be repurposed or upgraded to serve AI customers with far higher returns on investment.

There is also strategic signaling at work. By prioritizing AI infrastructure, memory manufacturers align themselves with governments, cloud giants, and national industrial strategies that increasingly view AI as critical infrastructure rather than consumer electronics.

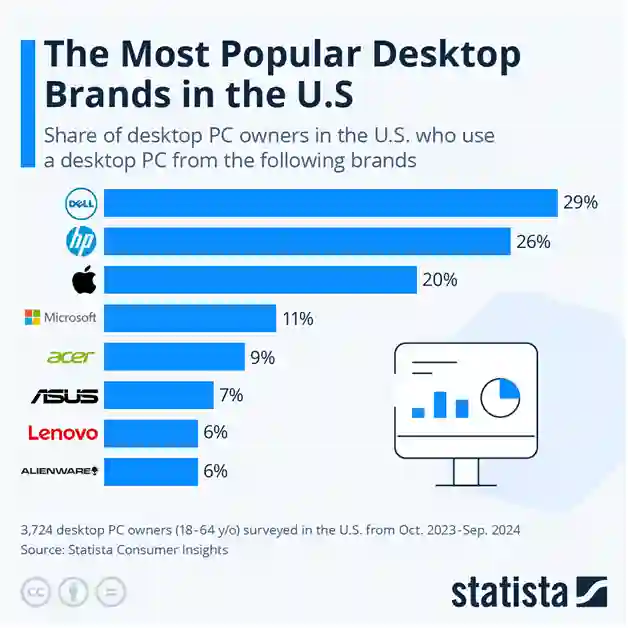

Comparing Consumer RAM and AI Data Center Memory

| Aspect | Consumer RAM | AI Data Center Memory |

| Primary Buyers | PC, smartphone, console manufacturers | Hyperscalers, AI labs, cloud providers |

| Profit Margins | Low to moderate | High |

| Customization | Minimal | Extensive |

| Pricing Stability | Highly volatile | Contract-based, stable |

| Strategic Importance | Incremental | Mission-critical |

| Supply Constraints | Overcapacity common | Chronic shortages |

This contrast explains why capital is flowing away from consumer segments and into AI-focused production lines.

Impact on the Consumer Market

For consumers, the effects of this shift are subtle but accumulating. RAM shortages in the consumer market are no longer driven solely by demand spikes, but by constrained supply. When manufacturers allocate their best wafers and newest nodes to AI customers, consumer-grade memory increasingly relies on older processes.

This has several consequences. Price drops are slower and less predictable. Performance gains arrive less frequently. Certain capacity tiers become scarce, particularly high-density modules that compete directly with data center production.

The gaming and enthusiast PC market feels this most acutely. High-capacity, high-speed RAM kits now cost more relative to historical norms, even when broader consumer electronics prices stagnate or fall. Laptop and smartphone manufacturers also face tighter margins, sometimes leading to conservative memory configurations that frustrate users.

Impact on Commercial and Enterprise Markets

The commercial market sits uncomfortably between consumers and hyperscalers. Enterprises upgrading servers, workstations, and private clouds increasingly compete with AI giants for access to memory. While they have more purchasing power than individual consumers, they lack the long-term contracts and volume commitments of hyperscalers.

As a result, enterprises often face higher procurement costs and longer lead times. This impacts everything from database servers to virtualization clusters and edge computing deployments. In some regions, particularly emerging markets, access to affordable enterprise-grade memory is becoming a bottleneck for digital transformation initiatives.

Small and medium-sized businesses are especially vulnerable. They lack negotiating leverage and often rely on commodity hardware. Rising memory costs translate directly into higher IT expenses and slower upgrade cycles.

The Role of Governments and Geopolitics

Memory manufacturing has become a geopolitical asset. Governments view AI infrastructure as strategically vital, and memory is one of its most constrained components. Subsidies, export controls, and industrial policy increasingly favor AI-aligned production.

This environment reinforces manufacturers’ decisions. Producing consumer RAM rarely qualifies for strategic incentives, while AI-focused memory often does. Over time, this policy bias accelerates the decline of consumer prioritization even if end-user demand remains strong.

Learn more: How to Write Effective AI Prompts for Adobe Firefly

Ethical and Societal Implications

The shift toward AI data center memory raises ethical questions about access and equity. When the best memory technology is reserved for large corporations and national AI initiatives, consumer innovation risks stagnation. Educational institutions, researchers, and startups may struggle to access affordable hardware capable of supporting modern workloads.

There is also an environmental dimension. AI data centers consume enormous amounts of energy and resources. Concentrating memory production around these facilities amplifies their footprint, while potentially reducing incentives to improve efficiency in consumer devices that collectively serve billions of users.

Long-Term Consequences for Innovation

The retreat from consumer RAM does not mean consumer computing will collapse, but it does signal a reordering of priorities. Innovation increasingly flows from the top down. Technologies developed for AI data centers eventually trickle into consumer products, but often years later and at a higher cost.

This reverses a historical pattern in which consumer markets drove scale and affordability. Today, consumers are downstream beneficiaries rather than primary customers. The pace of improvement in personal computing may slow, even as AI infrastructure advances at breakneck speed.

What Consumers and Businesses Can Expect Next

In the near term, consumers should expect RAM pricing to remain volatile and upgrades to feel less rewarding than in previous decades. Businesses should prepare for tighter procurement cycles and consider memory efficiency as a strategic concern rather than an afterthought.

Over the longer term, alternative architectures, including more efficient memory hierarchies and software optimization, may partially offset hardware constraints. However, as long as AI data centers dominate demand, consumer markets will remain secondary.

Conclusion

The decision by major RAM manufacturers to step back from consumer markets in favor of AI data centers is not a passing trend. It reflects a deeper transformation in how value is created in the technology industry. Memory, once a commodity serving billions of users, is becoming a strategic resource concentrated in fewer hands.

For consumers, this means higher costs and slower gains. For businesses, it means tighter margins and increased competition for infrastructure. For society, it raises questions about who benefits most from technological progress.

Understanding this shift is essential because memory may be invisible to most users, but it now sits at the center of the AI-driven future, shaping the global economy.