Loan EMI Calculator with Amortization Schedule (Free Online Tool)

Managing loans can be stressful, especially when you don’t know how much you’ll be paying every month. Our Free Loan EMI Calculator with Amortization Schedule helps you calculate your monthly EMI, total payment, and interest cost in seconds.

Whether you’re planning a home loan, car loan, personal loan, or education loan, this tool gives you a clear picture of your repayment journey. You’ll not only see the monthly EMI but also a detailed amortization table that breaks down interest and principal payments month by month.

Use this calculator before applying for a loan to make smarter financial decisions.

Loan / EMI Calculator

What is an EMI?

EMI (Equated Monthly Installment) is the fixed amount you pay every month to repay a loan.

Each EMI has two parts:

- Principal: The portion of the loan amount you repay.

- Interest: The cost charged by the bank/lender.

The EMI remains fixed every month, but the interest portion decreases over time while the principal portion increases.

How to Calculate Loan EMI?

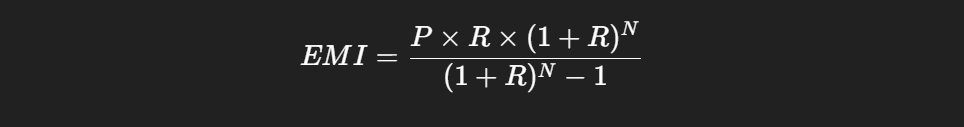

The formula for calculating EMI is:

Where:

- P = Loan Amount

- R = Monthly Interest Rate (Annual Rate ÷ 12 ÷ 100)

- N = Loan Tenure in Months

Example:

- Loan Amount = Rs. 500,000

- Interest Rate = 10% per year

- Tenure = 5 years (60 months)

EMI = Rs. 10,624 per month

Amortization Explained

Amortization means breaking down the loan into small, regular payments over time.

Your EMI covers both interest and principal. In the beginning, a large portion of EMI goes toward interest. As time passes, the interest decreases and the principal repayment increases.

Here’s how a Rs. 100,000 loan at 12% annual interest for 1 year looks:

| Month | EMI (Rs) | Interest (Rs) | Principal (Rs) | Balance (Rs) |

|---|---|---|---|---|

| 1 | 8,885 | 1,000 | 7,885 | 92,115 |

| 2 | 8,885 | 921 | 7,964 | 84,151 |

| 3 | 8,885 | 842 | 8,043 | 76,108 |

| … | … | … | … | … |

| 12 | 8,885 | 88 | 8,797 | 0 |

(This table is for illustration; your calculator shows the full schedule.)

FAQs on Loan EMI Calculator

Can I use this EMI calculator for a Home Loan?

✅ Yes. Simply enter your loan amount, interest rate, and tenure. The calculator works for home loans, car loans, personal loans, and education loans.

Does the EMI remain the same throughout the loan?

✅ Yes, the EMI remains fixed, but the interest vs. principal portion changes over time.

What happens if I repay early (prepayment)?

✅ Prepayment reduces the outstanding balance, which lowers total interest cost. Some banks may charge a small penalty for early repayment.

Can I calculate EMI without interest?

✅ Yes. If you set the interest rate to 0%, the EMI will be simply the loan amount ÷ the number of months.

Why is my initial EMI mostly interesting?

✅ In the beginning, the lender collects more interest. Over time, the interest decreases while the principal repayment increases.

Check our Image to PDF converter. You can also create a Barcode for your project.

So this is a complete loan and EMI calculator for you. Use it and check your Loan/EMI easily.